rsu tax rate canada

This is true whether were talking. Also restricted stock units are subject.

How To Grant Stock Options To Foreign Employees

RSU Withholding Rate A Common Confusion.

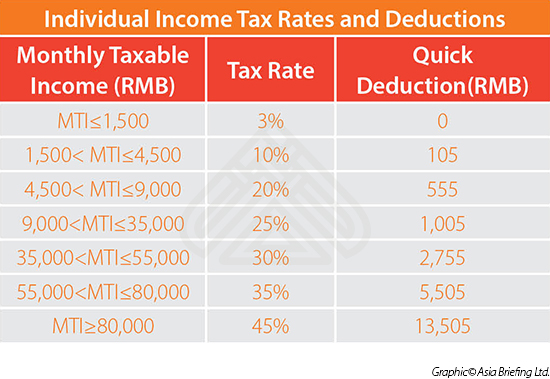

. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSUs do not create a tax burden unless the stock price has changed since the RSU vested. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

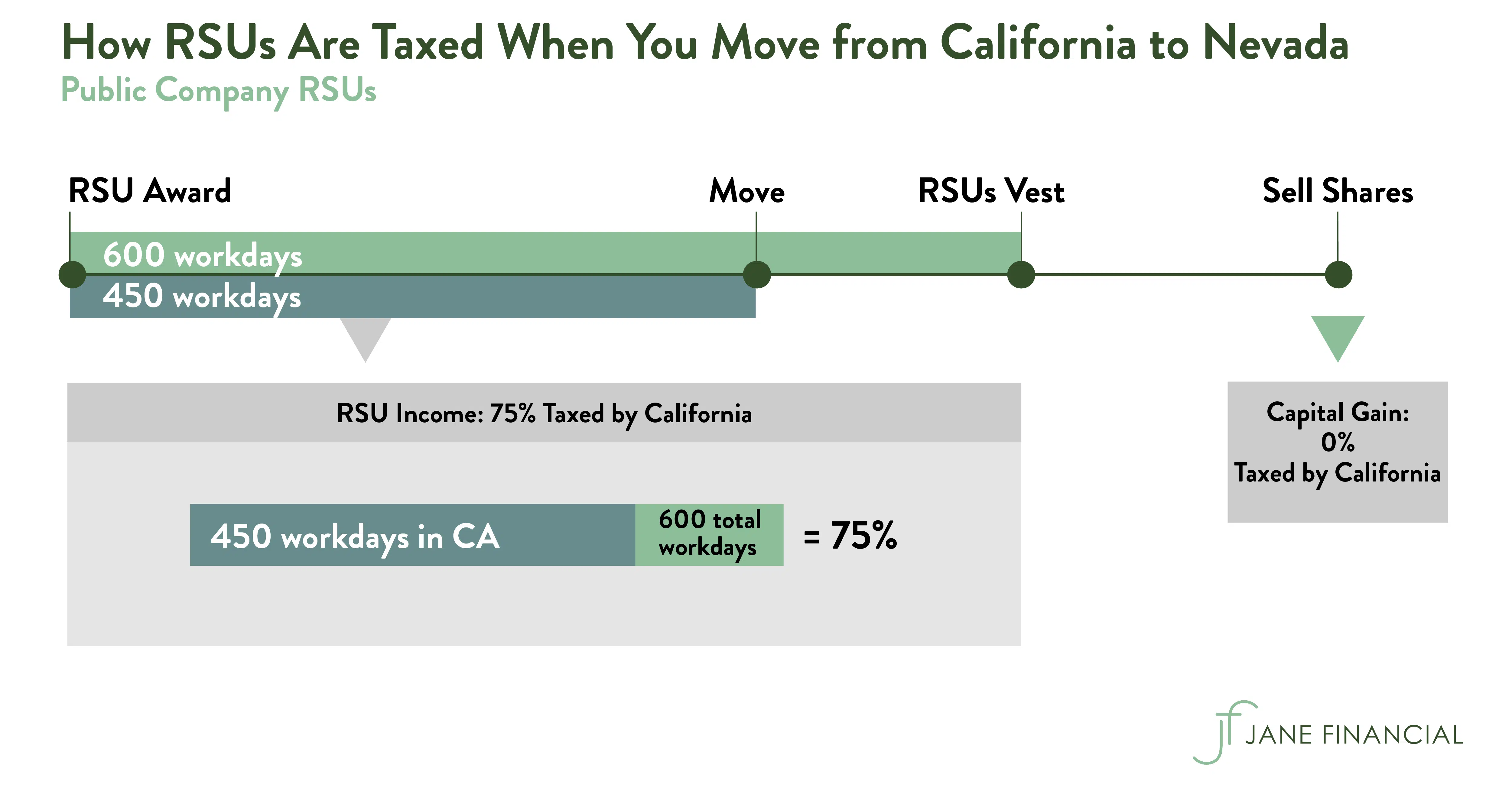

RSUs can trigger capital gains tax but only if the. Taxes are usually withheld on income from RSUs. Generally tax at vesting for RSU.

As you might assume this fundamental difference leads to stock options and RSUs being treated differently under tax laws. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Alice has 25000 worth of rsu stock vest in 2019 meaning alice now owns the stock outright.

Taxable amount is fair market value of the shares on the tax event. Growth after they vest will be taxed like capital gains half your marginal rate. Its important to remember that the RSU tax rate will be the same as your income tax rates.

RSUs are treated like income as they should be. Im curious how tech companies do tax deductions when granting RSUs in Canada. If RSUs are settled in cash or can be settled in cash or shares.

Generally there is no. RSU Tax Rate vs. A friend of mine told me they typically deduct the highest marginal tax rate 50 and so you.

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. In Canada RSU plans are commonly referred to as phantom plans because under an RSU plan the employee initially receives notional units not shares.

The beauty of rsus is in the simplicity of the way they get taxed. Please note that if your RSU income is taxed above 22 when your taxes are filed depending on your other tax withholdings you may owe additional taxes when you file. Canadas top marginal rate is 53.

The units represent a. Note that unlike stock options which are eligible for the stock option deduction and hence are taxed at 50 percent there is no favourable tax treatment accorded to RSUs. No matter whether you sell or hold the RSU you will be taxed on the full value of the.

A Literature Review On The Dual Effect Of Corporate Tax Planning And Managerial Power On Executive Compensation Structure Hlaing 2022 Accounting Perspectives Wiley Online Library

Taxation Of Stock Options For Employees In Canada Madan Ca

Rsu Tax Treatment Between Us And Canada R Tax

Canada Taxation Of International Executives Kpmg Global

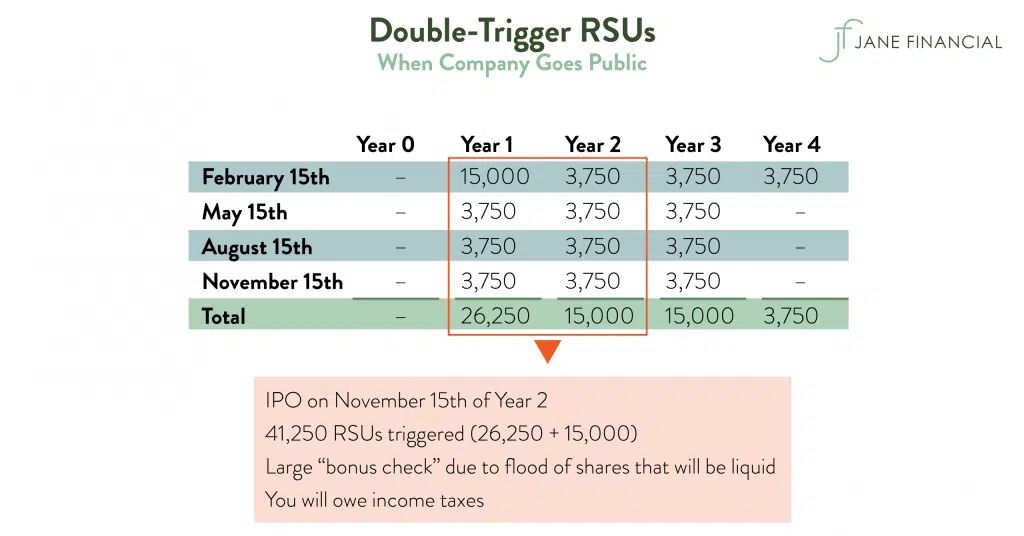

Restricted Stock Units Jane Financial

Rsus A Tech Employee S Guide To Restricted Stock Units

Rsu Taxes Explained Tax Implications Of Restricted Stock Units Picnic Tax

The Taxation Of Rsus In An International Context Sf Tax Counsel

Granting Restricted Stock Units To Your Employees In China China Briefing News

Restricted Stock Units Jane Financial

2021 Capital Gains Tax Rates In Europe Tax Foundation

Restricted Stock Rsus Top 10 Questions To Ask To Make The Most Of Your Grant The Mystockoptions Blog

Restricted Stock Units Jane Financial

A Guide To Restricted Stock Units Rsus And Divorce

Canada Government Moves Forward With Deduction Limit On Stock Options

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen